I. Introduction

Decentralized exchanges (DEXs) have gained popularity in recent years due to their greater security, anonymity, and lower fees compared to centralized exchanges. As the cryptocurrency market continues to evolve, so too do the trends in decentralized exchanges. In this article, we will discuss some of the emerging trends in decentralized exchanges and what they mean for the future of the industry.

II. Decentralized Exchange Trends

A. Increased Adoption of Decentralized Finance

Decentralized finance (DeFi) has become one of the hottest trends in the cryptocurrency market. DeFi protocols allow users to lend, borrow, and trade cryptocurrencies without the need for intermediaries. As the DeFi market continues to grow, so too does the demand for decentralized exchanges. This trend is expected to continue in the coming years as more users turn to DeFi for their financial needs.

B. Improved User Experience

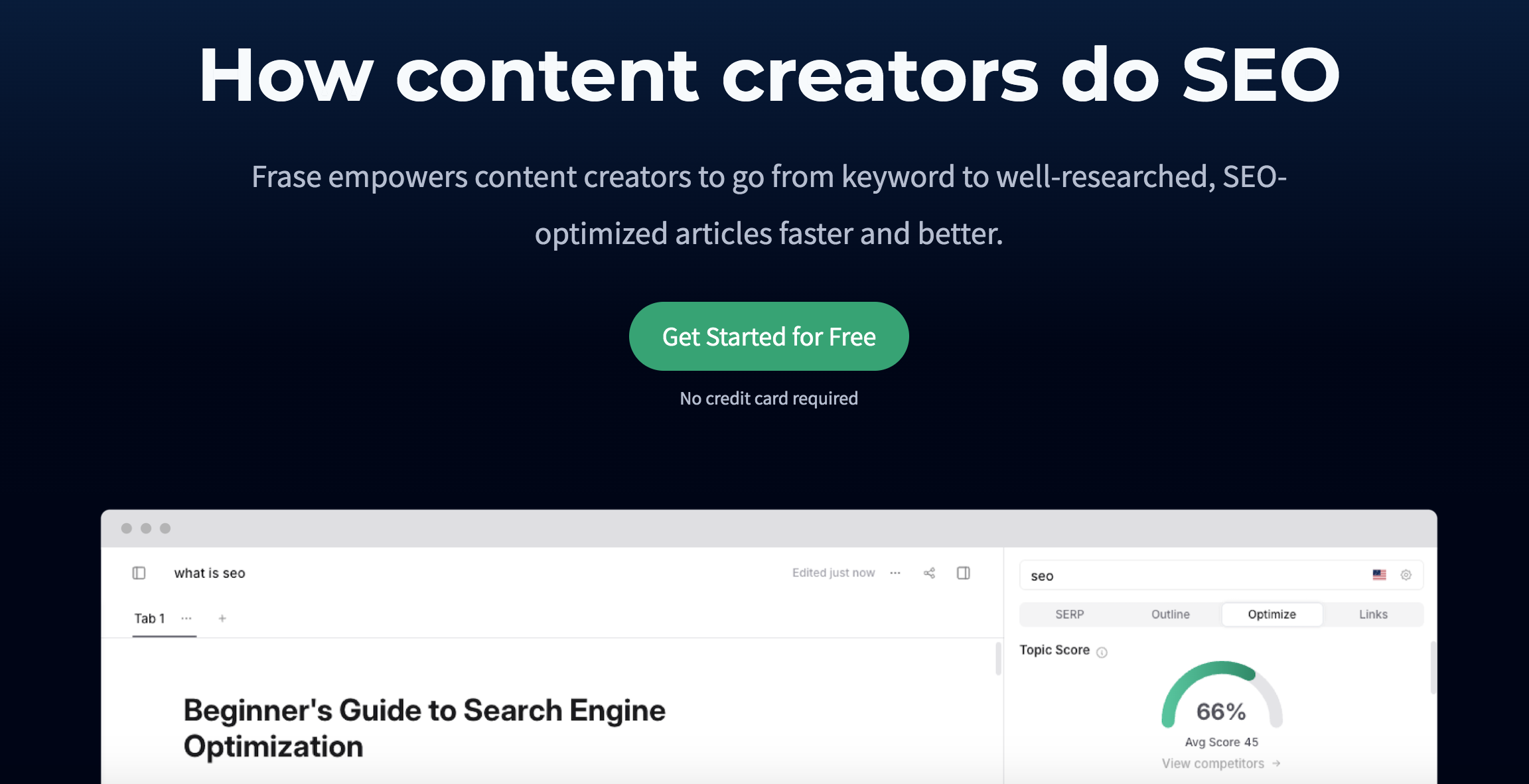

One of the main challenges facing decentralized exchanges is the user experience. Many DEXs have complex interfaces and can be difficult to navigate, especially for new users. To address this issue, many DEXs are focusing on improving the user experience by simplifying the interface and providing better support. This trend is expected to continue as more DEXs compete for users in a crowded market.

C. Enhanced Liquidity

One of the biggest challenges facing decentralized exchanges is liquidity. Unlike centralized exchanges, which have a large number of buyers and sellers, DEXs can suffer from low liquidity. To address this issue, some DEXs are implementing liquidity pools, which allow users to pool their funds together to provide greater liquidity for trades. This trend is expected to continue as more DEXs look for ways to improve liquidity and attract more users.

D. Integration with Centralized Exchanges

While decentralized exchanges offer several advantages over centralized exchanges, they also have some limitations, including limited functionality and lower liquidity. To address these issues, some DEXs are exploring the possibility of integrating with centralized exchanges. This would allow users to access the benefits of both types of exchanges, such as greater liquidity and more trading options.

E. Cross-Chain Compatibility

Another trend in decentralized exchanges is cross-chain compatibility. This refers to the ability of DEXs to support trading between different blockchains. Currently, most DEXs only support trading between tokens on the same blockchain. However, as more blockchains are developed, there is a growing demand for cross-chain compatibility. This trend is expected to continue as more DEXs look to support trading between different blockchains.

III. Challenges and Opportunities

A. Regulatory Challenges

One of the biggest challenges facing decentralized exchanges is regulatory uncertainty. While some countries have embraced cryptocurrency and blockchain technology, others have been more skeptical. This can create challenges for DEXs operating in those countries and can limit their growth potential. However, as more countries develop clear regulations for cryptocurrency and blockchain technology, there is an opportunity for DEXs to expand their reach.

B. User Education

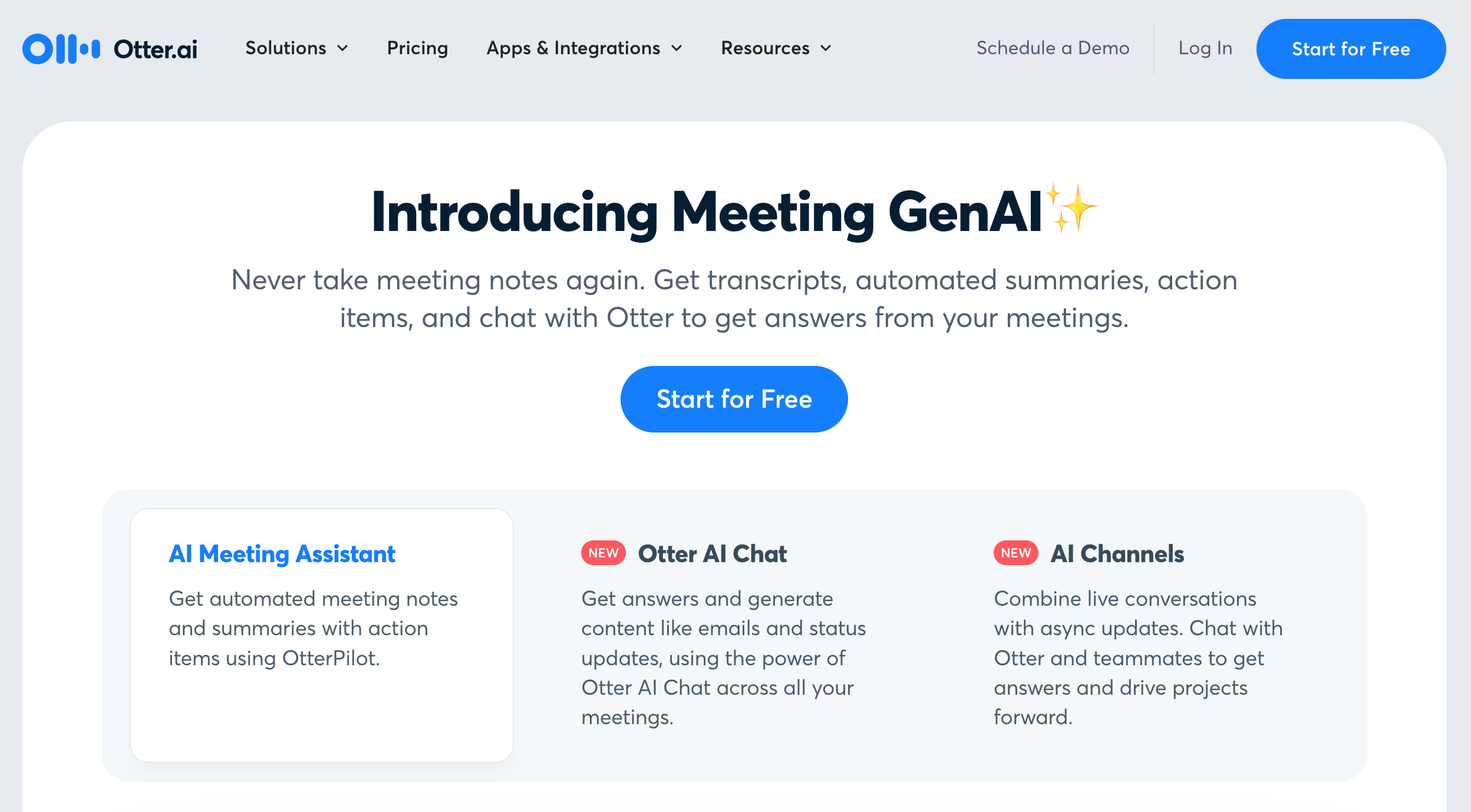

Another challenge facing decentralized exchanges is user education. Many users are not familiar with how DEXs work and may be hesitant to use them. To address this issue, DEXs need to focus on educating users about the benefits of decentralized exchanges and how to use them. This can help increase adoption and expand the user base for DEXs.

C. Growth Potential

Despite the challenges facing decentralized exchanges, there is also significant growth potential in the industry. As more users become interested in cryptocurrency and blockchain technology, the demand for decentralized exchanges is likely to grow. Additionally, as the technology behind DEXs continues to improve, the user experience is likely to become more seamless, which could help attract more users.

IV. Conclusion

Decentralized exchanges are an important part of the cryptocurrency market, offering users greater security, anonymity, and lower fees compared to centralized exchanges. As the industry continues to evolve, there are several emerging trends in decentralized exchanges, including increased adoption of DeFi, improved user experience, enhanced liquidity, integration with centralized exchanges, and cross-chain compatibility. While there are some challenges facing DEXs, such as regulatory uncertainty and user education, there is also significant growth potential in the industry. As such, it is important for investors and users to stay informed about the latest trends and developments in the world of decentralized exchanges.