Introduction

Decentralized exchanges (DEXs) have gained significant attention in the cryptocurrency world in recent years. While traditional centralized exchanges have been the dominant platform for trading cryptocurrencies, DEXs offer a number of unique advantages that make them an attractive option for many users. In this article, we’ll explore everything you need to know about decentralized exchanges, including what they are, how they work, and the benefits and drawbacks of using them.

What are decentralized exchanges? Decentralized exchanges are peer-to-peer platforms that allow users to trade cryptocurrencies without the need for a centralized intermediary. In contrast to centralized exchanges, where users deposit their funds onto the exchange and trust the exchange to hold and manage their assets, DEXs allow users to retain control of their assets at all times.

How do decentralized exchanges work? Decentralized exchanges operate using smart contracts, which are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. Smart contracts enable automated trades to take place without the need for a centralized intermediary. In other words, trades on a DEX are settled by the blockchain itself, rather than by a centralized exchange.

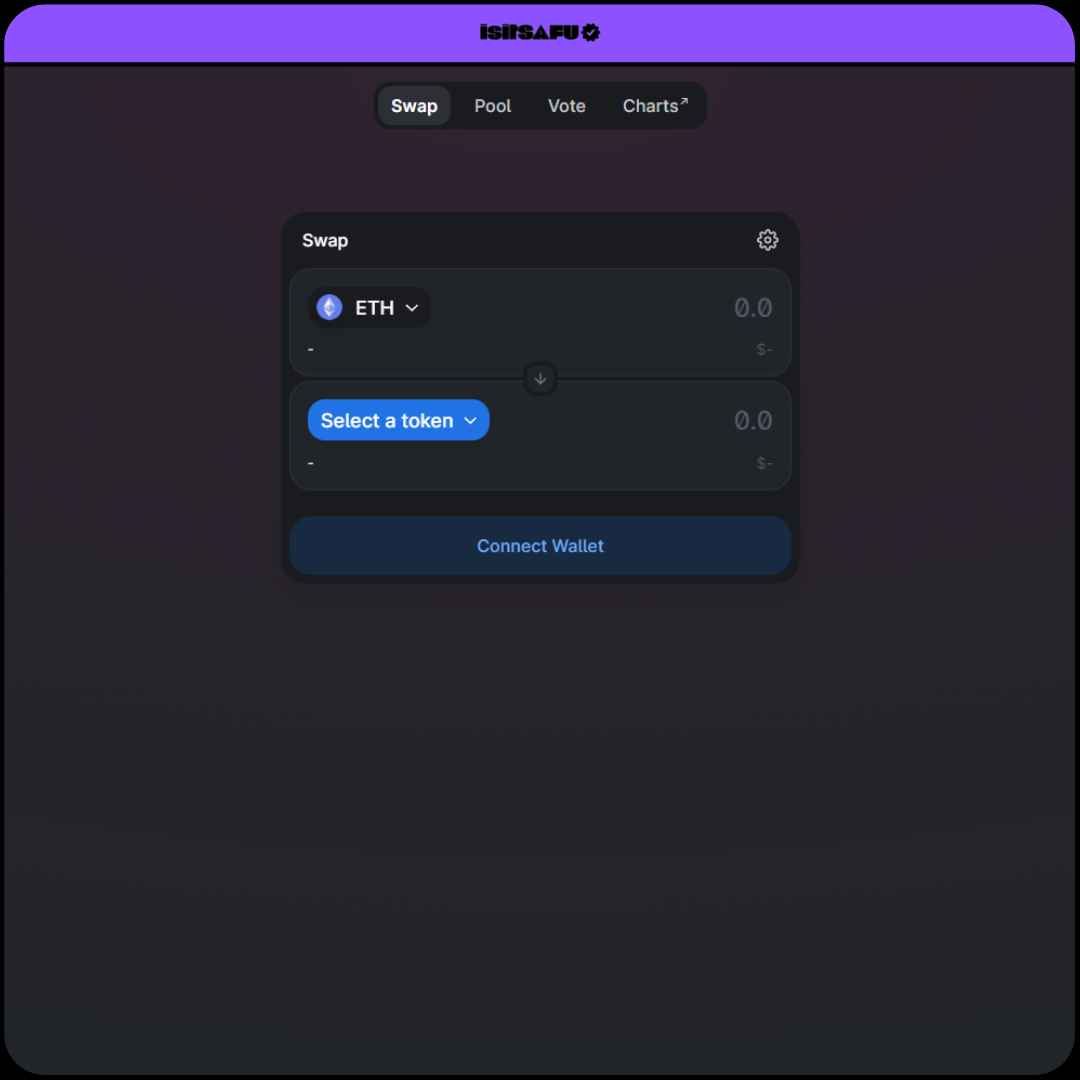

To use a DEX, users connect their cryptocurrency wallet to the platform and place buy or sell orders for a particular cryptocurrency. The DEX then matches buyers and sellers using an order book or an automated market maker (AMM) algorithm. Once a trade is executed, the cryptocurrency is transferred directly between the two parties’ wallets.

Benefits of using decentralized exchanges

- Security: DEXs are generally considered to be more secure than centralized exchanges, as users retain control of their assets at all times. This reduces the risk of theft or loss due to a hack or a dishonest exchange operator.

- Transparency: Decentralized exchanges operate on a public blockchain, which means that all trades and transactions are visible to anyone. This provides a high level of transparency and reduces the risk of market manipulation.

- Lower fees: DEXs generally have lower fees than centralized exchanges, as they do not need to cover the costs of running a centralized platform and providing customer support.

- No need for KYC: Many DEXs do not require users to complete Know Your Customer (KYC) checks, which preserves the privacy of users.

Drawbacks of using decentralized exchanges

- Complexity: Decentralized exchanges can be more complex and difficult to use than centralized exchanges, particularly for users who are new to the cryptocurrency space.

- Lower liquidity: DEXs typically have lower liquidity than centralized exchanges, which can lead to wider bid-ask spreads and slower order execution times.

- Limited trading pairs: DEXs often have a limited number of trading pairs available, which can limit the options for users who want to trade less popular cryptocurrencies.

- Price slippage: Due to the nature of automated market makers, DEXs can experience price slippage, which means that the price of an asset can change rapidly in response to changes in supply and demand.

Types of decentralized exchanges

There are two main types of decentralized exchanges: order book-based DEXs and automated market maker (AMM) DEXs.

Order book-based DEXs operate in a similar way to centralized exchanges, using an order book to match buyers and sellers. Examples of order book-based DEXs include IDEX and EtherDelta.

AMM DEXs, on the other hand, use an algorithm to determine the price of an asset based on its supply and demand. Instead of an order book, trades are executed based on the ratio of two assets in a liquidity pool. Examples of AMM DEXs include Uniswap and PancakeSwap.

Examples of decentralized exchanges

- Uniswap: Uniswap is one of the most popular DEXs in the cryptocurrency space, operating on the Ethereum blockchain. It is an AMM DEX that allows users to trade a wide range of ERC-20 tokens.

- PancakeSwap: PancakeSwap is a DEX that operates on the Binance Smart Chain. It is also an AMM DEX and is known for its low fees and fast transaction times.

- Curve: Curve is an AMM DEX that is designed specifically for trading stablecoins. It is popular among users who want to trade stablecoins with low slippage and low fees.

Conclusion

Decentralized exchanges offer a number of advantages over centralized exchanges, including increased security, transparency, and lower fees. However, they also have some drawbacks, including lower liquidity and more complexity. There are two main types of DEXs: order book-based and AMM-based, with examples including Uniswap, PancakeSwap, and Curve. Whether or not to use a DEX is a personal choice that depends on the user’s needs and preferences. However, as the cryptocurrency space continues to evolve, it is likely that DEXs will play an increasingly important role in the ecosystem.