Introduction:

Cryptocurrencies have become an increasingly popular investment option in recent years, thanks to their potential for high returns and their unique technology. However, investing in cryptocurrencies can be a risky endeavor if you don’t know what you’re doing. In this article, we’ll discuss some common mistakes that investors make when investing in cryptocurrencies and how to avoid them.

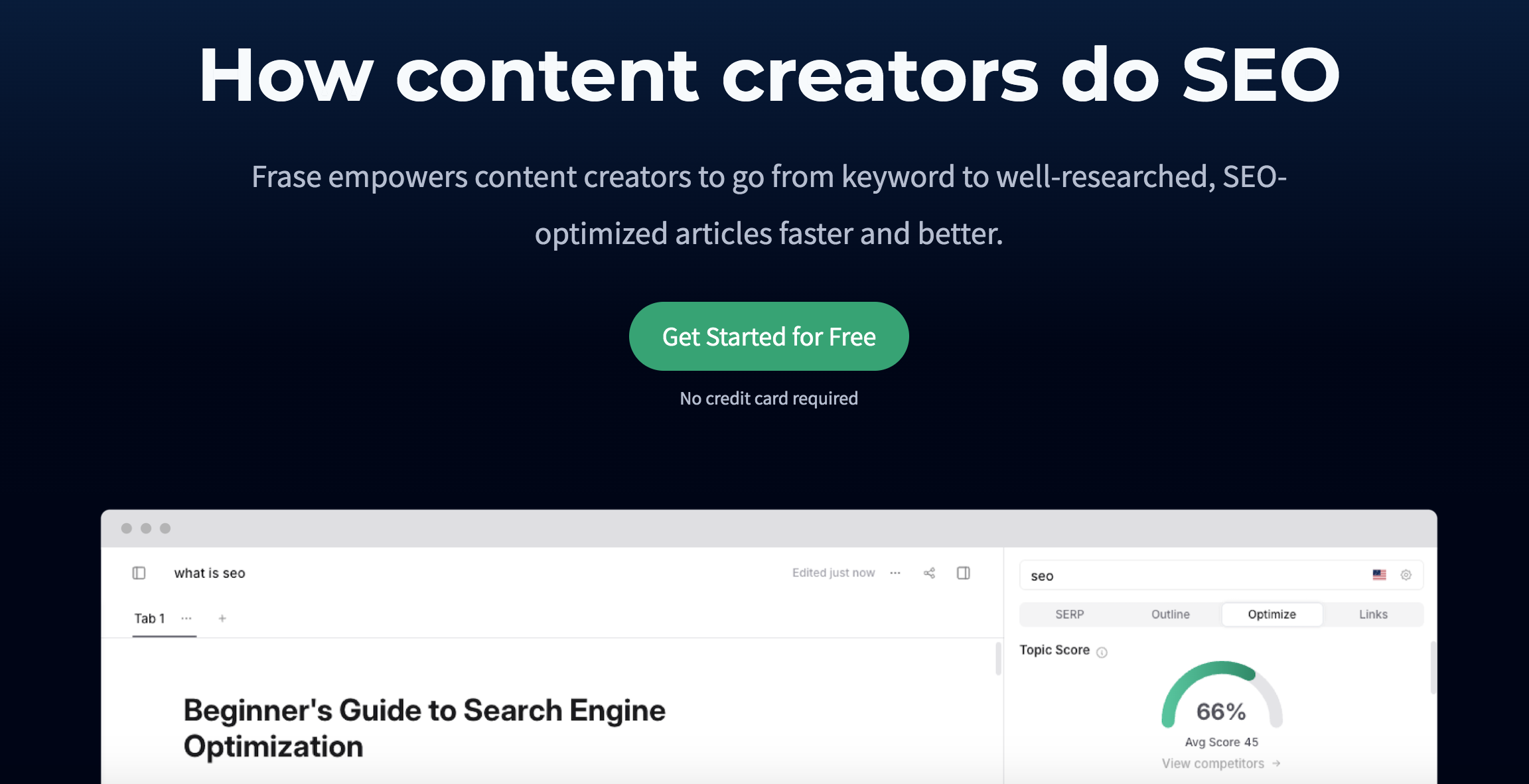

Mistake #1: Investing Without Doing Your Own Research:

One of the biggest mistakes that investors make when investing in cryptocurrencies is investing without doing their own research. It’s easy to get caught up in the hype surrounding a particular cryptocurrency and invest based on others’ recommendations without understanding the technology behind it or the risks involved. It’s important to do your own research, read whitepapers, and understand the technology and the market before investing.

Mistake #2: Investing More Than You Can Afford to Lose:

Investing in cryptocurrencies can be exciting, but it’s important to remember that it’s a risky investment. It’s crucial to invest only what you can afford to lose. Don’t put all of your savings into cryptocurrencies, and don’t take out loans or go into debt to invest.

Mistake #3: Not Diversifying Your Portfolio:

Another common mistake that investors make is not diversifying their portfolio. Investing in a single cryptocurrency can be risky, as the market is volatile and unpredictable. Diversifying your portfolio across different cryptocurrencies can help mitigate risk and provide more stable returns.

Mistake #4: Falling for Scams and Ponzi Schemes:

The cryptocurrency market is unregulated, making it a prime target for scams and Ponzi schemes. It’s important to be wary of any investment opportunities that sound too good to be true, as they likely are. Do your own research and only invest in reputable cryptocurrencies and exchanges.

Mistake #5: Focusing Only on Short-Term Gains:

Investing in cryptocurrencies can be exciting, but it’s important to have a long-term perspective. Focusing only on short-term gains can lead to poor investment decisions and missed opportunities. It’s important to consider the long-term potential of a cryptocurrency and its technology before investing.

Mistake #6: Not Understanding the Technology Behind Cryptocurrencies:

To be a successful cryptocurrency investor, it’s essential to understand the technology behind cryptocurrencies. Understanding the blockchain technology and the consensus mechanisms of different cryptocurrencies can help you make better investment decisions and avoid scams and Ponzi schemes.

Mistake #7: Panic Selling During Market Dips:

The cryptocurrency market is volatile, and prices can fluctuate rapidly. It’s important to have a long-term perspective and avoid panic selling during market dips. It’s natural for prices to fluctuate, and investing with a long-term perspective can help you avoid making rash decisions during market dips.

Conclusion:

Investing in cryptocurrencies can be an exciting and potentially lucrative investment option, but it’s important to be aware of the risks involved. Avoiding these common mistakes can help you make better investment decisions and mitigate risk. Remember to do your own research, invest only what you can afford to lose, diversify your portfolio, and have a long-term perspective. By following these guidelines, you can be a successful cryptocurrency investor and take advantage of the unique opportunities that cryptocurrencies offer. As always, it’s important to consult with a financial advisor before making any investment decisions.

In conclusion, investing in cryptocurrencies can be a rewarding investment option, but it’s important to avoid common mistakes that many investors make. By doing your own research, investing only what you can afford to lose, diversifying your portfolio, avoiding scams, having a long-term perspective, and understanding the technology behind cryptocurrencies, you can make informed investment decisions and take advantage of the potential benefits that cryptocurrencies offer. As with any investment, there are risks involved, and it’s important to consult with a financial advisor before investing. By following these guidelines, you can be a successful cryptocurrency investor and potentially achieve significant returns on your investment.